Table of Contents

1.1. Background of behavioural finance. 3

1.3. Objectives and aims of the study. 4

1.5. Significance of the research. 5

Chapter 2: Literature Review.. 6

2.1. Background to the concept of behavioral Finance. 6

2.2. Psychological foundations of behavioural finance. 8

2.2.2. Behavioural psychology. 12

2.3. Sociality and identity in behavioural economics. 14

2.3.1. Experimental evidence. 14

Social effects of behavioural Finance at SFK. 16

3.1. Background of SKF Company. 16

3.3. Financial position and dividend policy. 18

3.4. Application of social aspect of behavioural finance. 19

3.4.2. Personality Theories. 21

1. Chapter 1: Introduction

1.1. Background of behavioural finance

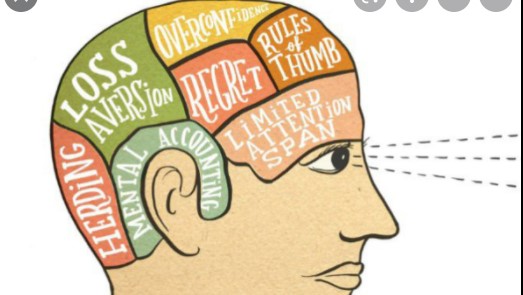

Behavioural finance is concerned with the reasons why economic agents make systematic errors. The definition of the concept of behavioral finance according to Investopedia is: “behavioral finance is a field of finance which attributes stock market anomalies to psychology based theories.” Behavioral Finance assumes that the characteristics of market participants and the information structure affect investment decisions of individuals and market outcomes. Phung (2009) suggests that behavioral finance combines behavioral and cognitive psychological theory with conventional economics and finance to provide reasons why people make irrational financial decisions. The main effect of behavioral finance is that the anomalies associated with it affect stock prices and returns. As a result, market inefficiencies occur. Some market participants also take advantage of such resultant inefficiencies in the market through arbitraging.

Before the emergence of the concept of behavioral finance, some theories and models such as CAPM, EMH and several other rational financial theories explained and predicted certain events in finance adequately. However, anomalies and psychological behaviors that had not been explained by such theories and models have now been recognized in finance and economics. Theories and models of finance explained idealized events but the real world has become messy with unpredictable behaviors of market participants. One of the inefficiencies highlighted by behavioral finance is under or over-reaction to information which is considered as the major cause of market trends, including extreme cases of bubbles and crashes.

There is also another form of behavioral finance referred to as quantitative behavioral finance which uses statistical and mathematical approaches to explain behavioral anomalies.

1.2. Problem Statement

There is little evidence to indicate the social impacts of behavioral biases and errors on market participants. However, behavioral economists have attempted to understand the behavioural aspects of finance by turning to scientists psychologists in order to understand the psychological and biological processes that drive human action. The social effects of behavioural finance are therefore influenced by the implications of psychological and biological processes on behavioural finance.

This dissertation seeks to determine the social effects of behavioral finance in the current economic world. Traditional economists may challenge the new field of behavioural finance, but its defenders provide several arguments to suggest that the concept is relevant in economic decision making. Some critics of behavioural finance suggest that the concept is a collection of anomalies; hence cannot be considered as a real branch of finance. However, cognitive biases that result from psychological, biological and social processes may have great social effects.

1.3. Objectives and aims of the study

The main aim of this study is to find out the social effects of behavioural finance. This is done through the analysis of various theories of behavioral finance in terms of psychological, biological and social processes. The research will also attempt to establish the link between behavioural finance and normative influences such as social norms and pressures. It will also identify the influences of psychological behaviour on finance decisions. Some of the objectives of this study are listed below:

- To determine the relationship between behavioural finance and normative influences such as social norms and pressure

- To find out the effects of psychological behaviours on finance decisions in the economy

- To find out the social effects of behavioral finance in terms of social norms and pressures as well as psychological and biological processes

- To establish the factors that escalate social effects of behavioral economics

- To find out ways in which such social benefits of behavioural finance can be resolved

1.4. Research Questions

- What is the relationship between behavioural finance and normative influences such as social norms and pressure?

- What are the effects of psychological behaviours on finance decisions in the economy?

- What are the social effects of behavioral finance in terms of social norms and pressures as well as psychological and biological processes?

- What are the factors that increase the social effects of behavioral economics?

- In what ways can the social effects of behavioral economics be solved?

1.5. Significance of the research

This research is relevant for many economic agents of the world economy: institutions, individual consumers, business people, business organisations, trading organisations and governments. It is more specifically important to economic agents in the stock market who buy or sell stocks. This is because the research will use an example of stock market to determine the social influence on decisions of buyers and sellers of stock in the stock market. Individuals make decisions in their normal undertakings in the market, especially in the stock market. Such decisions are often affected by certain psychological, biological and social factors. These factors may lead to biased decisions terms of financing options by firms and investment options by investors. Therefore, this research enables economic agents to identify the psychological and social limitations and complications that may affect their decision making. Economic agents can also use the research to make rational decisions in their economic decisions. The research can be used by business organisations to be aware of the different emotions and norms exhibited by their stakeholders including investors or shareholders, and which may affect the decisions of such individuals. Generally, the research is important tool for decision making in the new world order using the findings of the research.

2. Chapter 2: Literature Review

2.1. Background to the concept of behavioral Finance

Behavioral finance attempts to fill the gap created by various studies which try to explain the long-term historical phenomena in efficient market hypothesis (Investopedia, 2013). Conventional financial theory suggests that the market and its economic agents are rational wealth maximisers (Phung, 2009). However, emotions and psychology may affect our decisions in various ways. Since such decisions are related to our psychological and emotional aspects, they may result in various social effects such as loss aversions and depression. Anything related to psychological and emotional factors have social effects on individuals. The most important contribution of behavioral finance is that it has established various anomalies that most financial theories have failed to explain. Such anomalies are also referred to as irregularities or errors. Behavioral economics asks why some economic agents behave irrationally. Biases in decision making may cause irrational behaviors in market participants and such irrational behaviours are often against their interests (Phung, 2009).

Conventional economics and finance assume that economic agents make rational decisions in order to improve their wellbeing. In reality, people often behave irrationally (Frankfurter, 2009). Such irrationality is explained by psychological theories as the foundation of behavioral finance. Behavioral finance explains the anomalies and behaviours that rational financial theories could not explain. Phung (2009) suggests that the rational financial theories could explain certain idealized events, but the market place has proved to be a messy place where participants behave in an unpredictable manner. Conventional economics also suggests that emotions and other extraneous factors do not influence people’s economic decision making. Behavioral finance has attempted to include the fact that people frequently behave irrationally in economic decision making. A good example of irrational behaviors is gambling. It is quite irrational when someone buys an expensive lottery ticket where only one person among 1 million people can win the lottery. Behavioral finance takes into consideration cognitive psychology in order to explain the irrational and illogical behaviors made by economic agents and market participants in economic decision making.

Like any other economic field, behavioral finance has its own founding fathers. The fathers of behavioral finance are: Daniel Kahneman and Amos Tversky. The two have collaborated to produce over 200 works, most of which apply psychological concepts that have implications in behavioral finance. Kahneman received the Nobel Memorial Prize in Economics Sciences in 2002 for being a great contributor to the study of economic rationality. The duo has carried out good research in heuristics and cognitive biases that result in unanticipated irrational behavior among individuals. They published writings about prospect theory and loss aversion. Richard Thaler helped in the evolution of behavioral economics. He blended economics and finance with psychology to come up with such concepts as: the endowment effect, mental accounting and other biases.

Behavioral finance has also been criticized over time. Supporters of efficient market hypothesis are the most vocal critics of the behavioral finance theories. Efficient market hypothesis is a foundation of modern finance theories. The theory assumes that the market price of a security shows the impact of all the relevant information. Eugene Fama, the founder of market efficiency theory, suggests that market efficiency should not be totally abandoned despite the anomalies that are not explained by modern financial theory. He argues that most of the anomalies in economic decision making are short-term chance events which can be corrected after some time. He also claims that findings of behavioral finance seemingly contradict each other, and appears to be made up of several anomalies that market efficiency theories can explain.

2.2. Psychological foundations of behavioural finance

Behavioural economics draws its concepts from psychology and neuroscience. Therefore, the effects of behavioural finance can be identified from the knowledge of fundamental concepts from psychology and neuroscience. Psychology refers to the study of the process of individual minds and action which affect behaviour in a specific context. From this definition, it is clear that psychology may affect finance behaviour; hence causing some social effects on economic agents in financial markets. Behavioural finance focuses on psychological approaches, especially behavioural finance. Behavioural psychology is concerned with observed behaviour. This includes the psychological factors that drive people’s decisions. Some specific concepts of neuroscience and psychology have attracted the attention of behavioural economists. Such concepts include: personality theory, behavioural psychology and social psychology.

2.2.1. Personality theory

Personality theory explains the characteristics of individuals that determine the consistent patterns of behaviour among individuals. The importance of personality in economic decision making has been recognized because the differences in the levels of generosity among individuals may indicate the differences of sociality. An impulsive behaviour may lead to time inconsistency and impatience in financial or economic decision making. There are various personality theories that may explain the effects of behavioural finance. Such theories are explained in the section below.

Freud’s Psychoanalytic theory

Sigmund Freud’s psychoanalytic theory analyses personality and traits. In this approach, behaviour is considered as the result of interplays between basic drives, needs and conflict. In order to establish various forces that determine personality, Freud focused on three levels of consciousness: conscious, preconscious and unconscious thought. The focus on automatic versus deliberative processing by behavioural economics reflects Freud’s distinction between conscious, preconscious and unconscious thought.

Freud also analysed instinct in the development stages of a child. Obstacles to healthy childhood development may result in fixations of children if they remain stuck on a particular stage of development. Such fixations may lead to various pathological oral, anal or phallic personalities. Freud also suggested that an individual’s personality is driven by the interactions between the pleasure principle and the reality principle. The id is driven by the pleasure principle to seek gratification of basic instincts while the ego is driven by reality principle to seek gratification in a rational, practical way. The superego guides ethical attitudes. Ego is a victim of competing pressures from the id and superego, and reality.

Because economists are often concerned with making consistent choices, personality traits may influence such economic choices. Therefore, personality causes some social effects of behavioural finance. Such social effects can be explained using Freud’s analysis of identification in personality theory. Freud suggests that identification includes narcissistic identification, goal-oriented identification, object-loss identification, and aggressor identification. Narcissistic identification involves identifying with people who are similar to oneself; goal-oriented identification is concerned with identification of oneself with successful people; object-loss identification involves identifying with lost people and objects; and the aggressor identification entails identifying with authoritative personalities.

Cognitive goals

Cognitive goals involve cognitive functioning and intelligence. Measuring cognitive skills determines the ability of individuals to solve problems. This makes the concept of behavioural finance to be objective. However, it is difficult to measure cognitive skills due to the non-monolithic nature of intelligence. Alfred Benet, Theodore Simon and William Stern developed the IQ test which focused on intelligence as an overarching characteristic. Recently, general intelligence has been classified as a hierarchy of cognitive skills. Intelligence can be described in two perspectives: fluid intelligence and crystallized intelligence. Fluid intelligence is the ability to think laterally and problem-solve while crystallized intelligence is the intelligence gained from learning and experience. Measuring cognitive skills does not only involve objectivity. It can also be affected by certain factors, e.g. cultural factors, linguistic differences, conscientiousness and motivation.

Personality tests

Personality tests involve non-cognitive tests, which are even more difficult to measure than the cognitive tests. One example of personality test was developed by Kelly, and involved role construct repertory test. In this test, respondents were asked to name some key figures e.g. father, mother doctor, and teacher. They were then required to connect between them in terms of similarities and differences. This test involved a wide range of traits, but other tests have been developed recently which involve single trait or small number of traits.

Personality can also be measured using Myers-Briggs Type Indicator (MBTI). In this approach, conscious mental activity is captured in terms of: introversion versus extroversion; intuition versus sensing; thinking versus feeling; and judging versus perceiving. This test gave rise to sixteen types of personality styles. The Big Five Theory is also another method of personality testing. In this type of personality testing, personality is tested along five dimensions: openness, conscientiousness, extraversion, agreeableness and neuroticism.

Cognitive functioning

Behavioural finance is also concerned with cognitive functioning. Cognition can be clearly linked into the focus of standard economics on rationality assumptions. Cognition and emotion are greatly affected by differences among individuals. As a result, behavioural economists have started linking cognitive functioning with emotional processing. Behaviour always depends on situational cues. Self-control is also related to differences among individuals. A good cognitive functioning leads to good chances of life in adulthood. Cognition and emotion are also considered to affect the social information processing differently in different people. Therefore, finance decision making in behavioural finance is affected by cognition and emotion; which in turn result in different social behaviours.

2.2.2. Behavioural psychology

Behavioural finance and behavioural economics emerged from the works of behavioural psychologists. Behavioural psychologists rejected what Sigmund Freud and the psychoanalysts suggested – that behaviour is subjective and speculative. They pursued objective facts through observed choices and the direct and indirect impacts of stimuli on such choices. These observed behaviours in psychology links to the game theory and observed choices and preference in economics.

Behavioural psychology was developed by physiologist Ivan Pavlov who demonstrated classical conditioning by studying the eating behaviours of dogs. Ivan found that dogs started salivating before they ate food. This was shown by ringing a bell just before the dog was given food. After some time, the dog learnt the connection between the ringing bell and food. Therefore, it started salivating every time the bell was ringed. This salivation was considered as a learned, conditioned stimulus of receiving food. Association between stimuli, actions and rewards as developed by Edward Thorndike indicates the law of effect. This law states that the actions which produce pleasure give positive reinforcement, and will most likely be repeated. The law of exercise argues that a positive association is made, it is most likely that it is to be used and vice versa. The law of recency suggests that recent events will be more salient and they will most likely be repeated. The impacts of prior events are likely to decay over time.

Behavioural psychology has influenced behavioural economics. Behavioural economics use behavioural psychology methods by focusing on choices using experimental methods and basing such choices on cognitive and processes that affect economic decision making. As technology improves, behavioural approach becomes obsolete because as technology improves, the objective information available for decision making does not depend on studying what people do. With new technology, it is now possible to objectively measure psychological responses related to observed action.

2.2.3. Social psychology

Social psychology entails both psychology and sociology. Sociological emphasis on group influence and context dependence is blended with psychological personality and individual differences. Sociologists study the influence of social groups and contexts on individual behaviour. In order to achieve this, sociologists differentiate between normative and informational influences. Informational influences can be used to determine the impact of social groups on individuals by analysing them in an objective way. On the other hand, normative influences include norms and influences from social groups that affect human perceptions of behaviour. Sociological forces lead to interdependence, imitation and herding. Sociological forces also interact with psychological forces to cause various impacts on individual behaviour.

Social learning theory

Social scientists suggest that learning takes place within social contexts through observation and influence from role models. External reinforcements by outside events cause subjective influence on the behaviour of individuals. In this theory, loci of control influence the behaviours of individuals. Individuals with internal locus of control take charge of their own actions while those with external locus of control view events in context, including social context. Social learning theory suggests that people usually imitate behaviours exhibited by their role models.

2.3. Sociality and identity in behavioural economics

Sociality indicates that people usually use the actions of other people as a source of information with which they can make decisions given various economic or financing options. Social influences can be pervasive if they are used by individuals as basis of their preferences, utility and identity. This breaks the standard assumption of agents’ homogeneity and independence. Behavioural finance suggests that people develop their preferences not only for their own welfare, but also for that of others around them. Sociality is incorporated into behavioural economics through the incorporation of social preferences as elements of individuals’ utility functions. Social identity is radical, and departs away from standard models and from the traditional assumption of rationality.

2.3.1. Experimental evidence

Behavioural game theories are central elements of sociality. They derive their central concepts from the standard game theories. Some social games indicate that people do not always play games in a selfish way; hence behaviour does not converge onto Nash equilibrium as suggested by standard game theories.

Ultimatum games and dictator games

The ultimatum game is the most well known game in behavioural economics. Assuming there is a player X who has $50 dollars. He is required to give Y any amount from $1 to $49. Standard game theory applies monotonicity, i.e. more is preferred to less. In this case, X will offer minimum amount because he wants to keep as much as possible. Y will accept $1 because it is better than nothing. In standard game theory, players maximize their payoffs giving the choices of other players.

Experimental evidence shows a different situation in real life. Behavioural finance/economics indicate that players in a game are guided by what seems to be fair and just outcome. If 50% is considered to be fair, players will always offer close to 50% to their playmates. This is shown by experimental studies carried out by Guth et al (1982). Other experimental studies also suggest that proposers rejected offers close to 20%, and average offers were given to be 30-40%. Offers below 20% are rejected.

Experiments with trust games

Experiments with trust games were intended to study the concepts of reciprocity, social history, and trust. Berg et al (1995) tried to determine why people trust and whether trust is a primitive response or not. Using a trust game intended to test trust; Berg et al (1995) constructed a repeated game based on reputation and contractual pre-commitments. This test sought to establish the extent to which people trust others, and in turn receive trust from others. The study found out that trusting is a risk strategy which may not be reciprocated, and trustworthiness does not yield direct quick return.

This experiment was carried out in stages involving players As and Bs. As were in room A while Bs were in room B. Players As had $10 dollars and were tested whether they trust Bs by sending any amount of their money to Bs, or they may as well decline to send the money. Players in room B were tested with their ability to reciprocate. Standard game theory would suggest that player B’s strategy would be to keep everything and not to reciprocate. If B is entirely self-interested, then he has no incentive to reciprocate by being trustworthy. Through backward induction, player A will therefore keep everything for himself in anticipation that they will not get anything that they send to B.

2.3.2. Identity model

Social context affects behaviour; hence affecting identity. This can be inferred mainly from the social identity theory. This theory argues that social identities are easy to create, and such identities affect social behaviours. It indicates that people in a social group often extent favours to each other, hence creating their own social identity within the group. Social identity also affects intergroup identity and discrimination. Intergroup conflicts and discrimination often affects cooperative behaviour in the group.

Economic models of identity developed from Akerlof and Kranton suggest that the identities of people are determined by sociological factors. In this case, utility relies on self-image or identity, the actions of a person, and other people’s actions. The consumption of a person are determined by the person’s actions and the actions of others. Identity can also be affected by social categories and individual’s characteristics. Irrational actions in standard models are more sensible in identity model. For example, self-mutilating actions such as tattooing and plastic surgery are considered to be irrational by standard models. However, in identity models such actions generate utility by creating a person’s identity and sense of belonging to a group.

3. Social effects of behavioural Finance at SFK

3.1. Background of SKF Company

SKF is a multinational company dealing with the provision of technology. It was founded in 1907 and currently operates in more than 140 sites, providing technology to more than 40 industries in 32 countries. SKF has 46,775 employees who operate in various countries where the business operates. It also has 16 technical centres around the world. The main strength of the company is that it has the ability to develop new technologies continuously and use them to provide products that offer competitive advantage to customers.

3.2. SKF’s share trading

Shares are sold in SKF in five market segments. The volume of shares in each market segment and their market shares in form of percentages are shown below.

| Markets | Volume | Market share |

| NASDAQ OMX Nordic Stockholm | 39,010,064 | 61.3% |

| Chi-X Europe Limited | 11,554,400 | 18.2% |

| Bats Europe | 7,273,789 | 11.4% |

| Turquoise | 5,507,489 | 8.7% |

| Burgundy | 241,806 | 0.4% |

Figure 1: market shares

The main financial objective of SKF is to create value for its shareholders. The aim of the company is to provide shareholders with a return on their investment that exceeds risk-free interest rate by about five percentage points. In terms of share performance, SKF recorded 1,138 MSEK share capital, one voting right per share, and 5.50 SEK per share.

3.3. Financial position and dividend policy

SKF targets a gearing of 50% with an equity/asset ratio of 35% or net debt/equity ratio of 80%. The company’s financial flexibility and ability to invest in its business lead to a strong credit rating. The gearing ratio for the company in 2010 was 48.6%, the debt/equity ratio 80.5% and the equity assets ratio 36.0%.

The dividend policy of SKF provides that the total dividend needs to be adapted to the earnings and cash flow trend while maintaining the company’s development potential and financial position. In the view of SKF’s directors, ordinary dividends should amount to at least 50% of the average net profit as calculated within a given business cycle. If the financial position of the company becomes more than the stated objective, then the ordinary dividend would be given an additional distribution in the form of additional dividend. In times of uncertainty, a lower dividend may be provided. In 2012, dividends of SEK 5.50 per share were provided to shareholders, and a withholding tax rate of 30% was extended to foreign shareholders. The table below shows the dividend paid to shareholders since 1983 until 2010.

Fig 2: dividends of SKF since 1983

3.4. Application of social aspect of behavioural finance

3.4.1. Social learning

In terms of social psychology, it is clear that SKF considers the interests of social groups before giving dividends. The main financial focus of SKF is to meet maximum satisfaction of shareholders. This indicates that shareholders, as a group, determine the financial decisions of the company. Shareholders model each other’s behaviours in terms of their interests, and SKF attempts to meet such group interests. Furthermore, the share prices of the company are determined by the purchasing decisions of shareholders. If one shareholder (a role model) buys shares from the company, social learning theory suggest that more shareholders will join in and buy the company’s shares.

Information cascade and Herding behaviour

This theory ascertains that multidimensional uncertainty causes violent price movements. This occurs on rare circumstances when poorly informed agents herd. Information cascade causes individuals to make repeated decisions. Based on their maximisation problem, investors form a view on the value of an asset. The private signal and historical values of the asset also determine the investors’ views of the assets’ value. Risk Neutral dealers compete in price to satisfy the demand of investors. Once the investors decide on the value of the asset, historical information on the trades dominates the private signal. Private signals do not influence demand because investors are risk averse.

Information cascades can move from one financial market to another if two asset values are not independent. Therefore, history of trades in one market can be used as a source of information in the second market. Asset values also have two components: common component and private component. Agents often differ in the private component; hence causing heterogeneity. In herding behaviour, there are also two types of traders: noise traders and informed traders. Noise traders sell or hold assets based on exogenously given probabilities while informed traders sell or hold assets based on private information on common component of the asset value.

Social influence to decision making

In social psychology, social influences and social pressures usually affect individual’s actions. This is adopted by behavioural finance such that financing decisions of individuals are affected by social influences and social pressures within the economic context that led to the financing options. There is a social connectedness in economics and mathematics, which affects decision making in economics and particularly finance. Social influence is also concerned with the association with authority. In behavioural economics, individuals usually follow authority in their economic decision making.

3.4.2. Personality Theories

Freud’s Psychoanalytic theory

In terms of Freud’s psychoanalytic theory, it can be seen that SKF’s decision making in terms of financing is guided by interplay of drives, needs and conflict. The targets of 50% gearing ratio, 35% equity/asset ratio, and 80% net debt/equity ratio indicate the drive and needs of the company. They determine the financing decisions of the company. These targets reflect deliberative processing as suggested by Freud.

Cognitive skills theory

Cognitive skills are also applicable in behavioural finance. SKF utilizes cognitive functioning by adapting to earnings and cash flow trends. The intelligence of the finance department enables the company to understand the trend for earnings and cash flows based on development potential and financial position.

The process through which SKF provides additional distribution to ordinary dividend in form of higher dividend if the financial position exceeds its targets agrees with the behavioural psychology theories developed Edward Torndike. In this case, the law of effect suggests that actions which produce pleasure give positive reinforcement. Therefore, increased financial position produces pleasure; hence giving positive reinforcements in form of higher dividends. The law of recency is also applicable in the dividend policy of SKF. The most recent events in SKF are salient and are most likely to be repeated. From figure 2 which shows the dividends of SKF since 1983, split and redemptions occurred in 3 close years; 2004, 2006 and 2007. This shows that recent events are most likely to occur again, as compared to past events.

3.4.3. Social identity

Social identity also applies to the financial position and dividend policy of SKF. Shareholders and SKF are like a social family or a social grouping in which decisions are made based on identity of the group members. SKF identifies its ordinary shareholders in order to determine its dividend policy. On the other hand, shareholders identify themselves as the members of SKF in order to decide whether to buy, hold or sell shares belonging to the company.

Experimental evidence

In terms of experimental evidence, it is clear that behavioural finance affects the decisions of SKF because the company’s members are guided by what they consider as fair and just. By offering SEK 5.50 to shareholders as dividends, SKF considered it as fair and just.

Cooperation and punishment

People sometimes cooperate and sometimes they do not. Economic agents are always willing to pay to punish people who violate the norms. Social norms are behavioural regularities based on shared beliefs and the manner in which the society dictates that people should live. If people who violate social norms are not punished, those who initially cooperate will later defect. Cooperation and punishment usually affect investor and trader choices.

4. Conclusion

Behavioural finance plays a crucial role in financial decision of multinational organisations. This is evident from the example of SKF. The dividend policy of SKF indicates that the company takes into consideration the interests of its shareholders when setting financial objectives. Viewed as a social group, shareholders make decisions based on each other’s decisions. This shows the impact of social group influence as suggested by social theories including social learning theory. Therefore, behavioural finance brings together stakeholders of an organisation as a social group; hence forming identities and enabling decision making that is guided by social groups.

Behavioural finance also affects financial decision making by bringing in the influence of psychology. Cognitive skills guide the financing options of organisations while psychoanalytic theories provide drives and interests upon which business organisations build their decision making and make desirable choices. This is considered as a social effect because the psychological perspective of a business decision making bases its choices on drives and interests which affect other people in a socio-economic setting.

References list

Bailey, R. (2005). The Economics of Financial Markets. Cambridge: Cambridge University Press.

Berg, J. Dickhaut, J. and McCabe, K. (1995). Trust, Reciprocity and social theory. Games and Economic Behaviour, 10, 122-142.

Bradford, J.D.L., Shleifer, A. Summers, L.H. Waldmann, R.J. (1990). Noise Trader Risk in Financial Markets. The Journal of Political Economy, Vol. 98, No. 4 (Aug., 1990), pp. 703-738.

Camerer, C. F., Loewenstein, G., & Rabin, M. (2008). Advances in Behavioral Economics. Princeton: Princeton University Press.

Daniel, K., Hirshleifer, D. and Subrahmanyam, A. (1998). Investor Psychology and Security Market under- and Overreactions. The Journal of Finance, 53(6), 1839-1885.

Desai, H., Jain, P. (1997). Long-run common stock returns following splits and reverse splits. Journal of Business, 70, 409-433.

Etzioni, A. (2011). Behavioral Economics: Toward a New Paradigm. American Behavioral Scientist. 55(8), 1099-1119.

Fama, E.F. (1998). Market efficiency, long-term returns, and behavioral Finance. Journal of Financial Economics, 49, 283-306.

Frankfurter, G.M. (2007). Market Efficiency cum Anomalies, or Behavioral Finance? Homo Oeconomicus, 24(1), 81–93

Guth, W., Schmittberger, R. and Shwarze, B. (1982). An experimental analysis of ultimatum bargaining. Journal of Economic Behaviour and Organisation, 3(4), 367-388.

Holt, Charles A., and Susan K. Laury, 2002. Risk Aversion and Incentive Effects. The American Economic Review, 92(5), 1644-1655.

Investopedia (2013). Definition of Behavioral Finance. Accessed July 10, 2013 from http://www.investopedia.com/terms/b/behavioralfinance.asp.

Karlan, D. (2005). Using Experimental Economics to Measure Social Capital and Predict Financial Decisions. American Economic Review, 95(5), 1688-1699.

Lee, C. M. and Shleifer, A. and Thaler, R. H. (1991). Investor Sentiment and the Closed-End Fund Puzzle. The Journal of Finance, 46(1), 75-109

Le Bon, Gustave, (1896). The Crowd: A Study of the Popular Mind. London: T. Fisher Unwin.

Nava, A., Camerer, C.F., and Loewenstein, G. (2005). Adam Smith, Behavioral Economist. Journal of Economic Perspectives, 19(3), 131–145.

Oyserman, D., & Lee, S. W. S. (2008). Does culture influence what and how we think? Effects of priming individualism and collectivism. Psychological Bulletin, 134, 311-342.

Phung (2009). Behavioural Finance. Accessed February 12, 2014 from http://www.investopedia.com/university/behavioral_finance/

Salo, A.A. and Weber, M. (1995). Ambiguity Aversion in First-Price Sealed-Bid Auctions. Journal of Risk and Uncertainty, 11: 123-137.

Shiller, R.J. (2003). From Efficient Markets Theory to Behavioral Finance. The Journal of Economic Perspectives, 17(1), 83-104.

Thaler, R. H. (2005). Advances in Behavioral Finance, 2. Princeton: Princeton University Press.